Value Chain: Where Radiologists Should Put Their Focus in Threats Against Income

By Hardy SM

Several months ago, the Centers for Medicare & Medicaid Services (CMS) threatened to cut 10% of imaging/interventional evaluation and management (E&M) codes in order to shift reimbursement towards primary care and medical subspecialists. While ultimately these cuts were eliminated through congressional action, they were characterized by physician groups as potentially “devastating” and having “significant impact.”1,2

If radiologists chose to view their payer income as a metric of their value, the “devastating” messaging from our medical societies could have contributed to a diminished sense of worth or burnout. Yet a concept known as “value chain” allows threats like these to be placed in their proper context—while their income would have decreased, radiologists’ value to the health care system would not.

Thanks to value chain, individual radiologists have the liberty to conclude that the “devastating” rhetoric from organized medical societies may simply be hyperbole. Furthermore, calls to engage with government relations on behalf of organized medicine may induce less anxiety for radiologists who appreciate value chain, ultimately allowing them to focus on direct patient care activities rather than lobbyists’ “call to action.”

Value Chain Explained

Value chain is a strategic framework for how divisions within a firm create value, or how firms join together to create synergies. There are two fundamental variables in the value chain model; lowering costs and adding value to a good or service so that buyers will pay for that good or service.3 Ideas on how to lower costs within radiology have been discussed previously.4 However, a buyer’s willingness to pay for goods and services is an important value chain concept in the context of today’s opportunities and threats.5

As an example, imagine an ideal picture archiving and communications system (PACS) support team. That team would be geographically close to your reading room and provide an efficient PACS that rarely goes down. When the system does fail, that team is there to quickly bring it back up. That team’s value is ensuring that you can generate reports for the patients and ordering providers, move patients through a complex health care system, and go home on time.

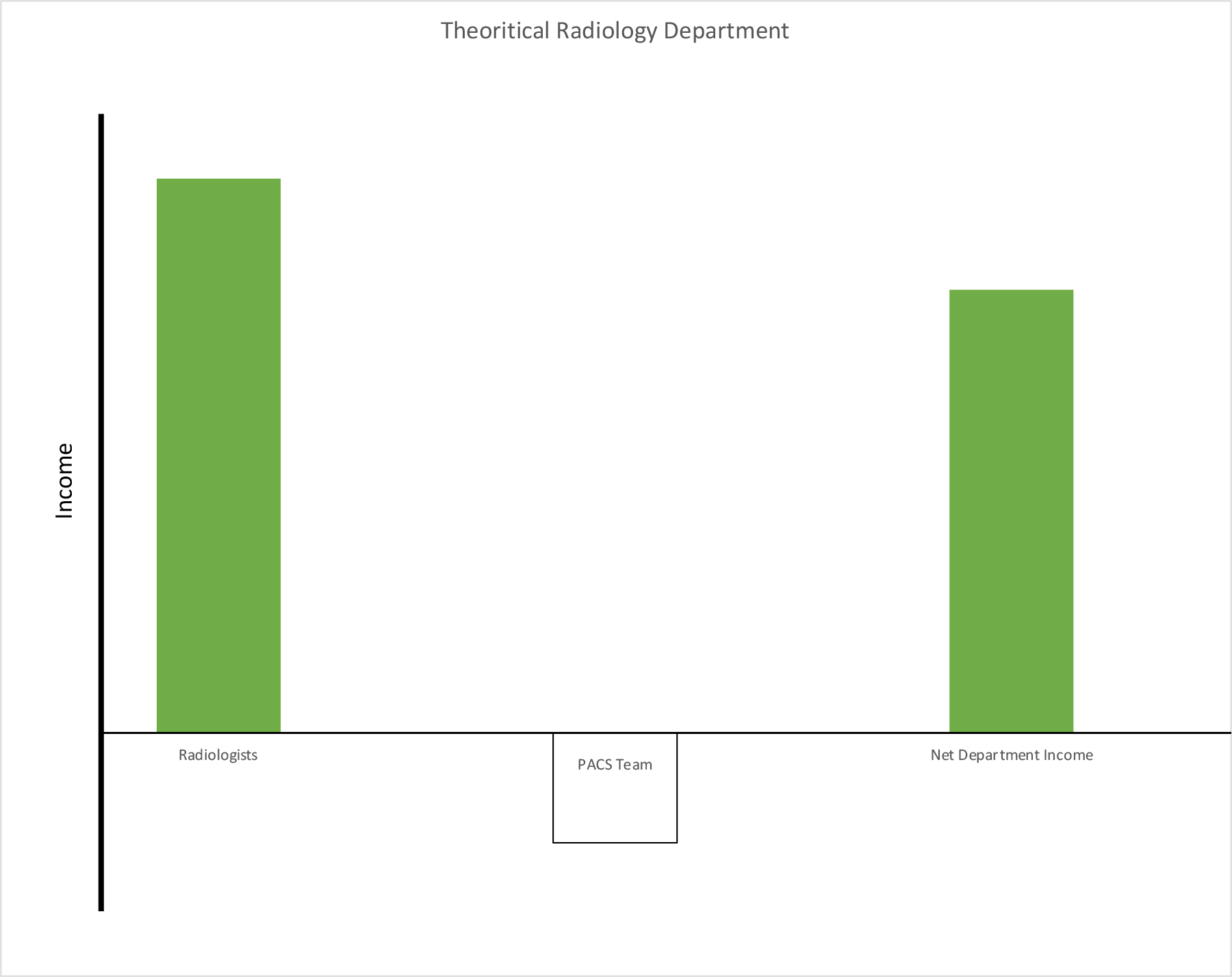

In the context of value chain, that ideal PACS team has immense value. However, they generate no income. Teams that are required for the operation of the organization, but lose money, are otherwise known as cost centers. Yet, since nothing gets done without that ideal PACS team, they hold tremendous value. The separation of income from value is a fundamental tenant of value chain. Ultimately, the net income from a radiology department might look something like Figure 1, where the net income of the department includes the PACS cost center.

Value Chain Applied to Radiologists

Radiologists can use this model to more clearly evaluate their opportunities for value creation. For example, without our interpretations most hospitals would be crippled within hours. Like that PACS team, our value within a system is independent of our revenue generation.

Government health care systems at Veterans Affairs (VA) or the Department of Defense (DoD) are closest to a pure value chain construct. In these departments, radiologists’ services do not generate income for the taxpayer. Instead, like their counterparts in PACS, radiologists are cost centers. Yet their taxpayer-funded health care systems would completely fail without their services. Government radiologists are highly valued, and value chain explains why the marketplace continues to have a significant willingness to pay their salaries. Again, being a cost center has nothing to do with professional value.

This VA/DoD example provides context for the seemingly never-ending threats to the private sector radiologists’ income, including those emanating from the CMS.

Value Chain Within a Larger Ecosystem

Radiologists entering the workforce have diminishing options in practice types compared to a generation ago. Independent groups are consolidating and becoming larger. Some are being acquired by large national public or private equity firms.6 Academic practices are also merging with community groups, further reducing job options within the marketplace.7 During the current cycle of consolidation, remembering that value chain works best when different divisions exist within one firm is important. This organizational diversity gives each division a unique opportunity to create value for the firm in a metaphorical chain of value creation.

Firms that are consolidating small groups into large groups have limited ability to create value, as they are all engaging in the same activity and have little ability to create new synergies.6 Furthermore from the perspective of the firm, cuts to reimbursement within one physician specialty become much more severe if all the physicians in that organization are in the same specialty.

Last year’s proposed CMS cuts would have been relatively more devastating to a large national radiology practice with no primary care physicians versus a more diverse and integrated academic medical center with numerous different physician types. Since value chain works best in firms where income streams are diversified, it was no surprise when at least one academic medical center decided to leave radiologists’ salaries unchanged through at least the 2022 academic year, despite the cuts threatened by CMS.8 Larger, diversified systems have the ability to diffuse shifts in CMS reimbursement and insulate radiologists from any “devastating” cuts.

While CMS revenue cuts should not be mistaken for a statement of our value within the health care ecosystem, and diversified systems have the ability to absorb any shifts in income on behalf of their employees, radiologists also need to be increasingly mindful of those undiversified private equity or publicly traded firms which have significant debt, otherwise known as leverage.9 Should CMS or other payers decide to shift payments away from radiologists towards primary care, radiologists within these undiversified firms will suffer a greater impact, as debt holders will be paid before any physician salaries.

So, while private/public equity firms can use leverage to amplify profits to the upside, leverage has an opposite effect when gross income is in decline. Any cuts to reimbursement would be truly devastating to these firms’ employees; since the debt holders get paid before the radiologists, the impact on employed radiologists’ salaries may be significant. As equity employed radiologists make up a greater share of dues-paying members within organized medical societies, it is easy to understand why the proposed CMS cuts were characterized as draconian by those societies. But a clear understanding of value chain by physicians is increasingly critical to evaluate the rhetoric of our medical society leadership.

Conclusion

Some payers are willing to pay more than others, yet radiologists remain among the most highly compensated specialties.10-11 There is no systemic lack of willingness to pay for our services. On the contrary, CMS has even paid for services not yet rendered during the COVID pandemic.12 That event was remarkable and signals a significant willingness among our public and private institutions to pay for our services into the future.

Physicians who understand value chain have the ability to think more strategically than those who do not. That understanding provides physicians with a level of contentment regarding our value within health care systems. It also highlights the potential weaknesses of firms that are poorly diversified or highly leveraged.

References

- Stempniak M. Congress averts Medicare cuts set to hit radiologists, sending final bill to president. Radiology Business. https://www.radiologybusiness.com/topics/policy/congress-averts-medicare-cuts-radiologists-president. Published April 14, 2021.

- Stempniak M. CMS drops final 2021 physician fee schedule that includes ‘deeply troubling’ cuts to radiologists’ pay. Radiology Business. https://www.radiologybusiness.com/topics/economics/cms-final-2021-physician-fee-schedule-cuts-radiologists-pay. Published December 2, 2020.

- Pearlson KE, Saunders CS. Strategic use of information resources in a global economy. In: Strategic Management of Information Systems. 5th Ed. Singapore: John Wiley & Sons; 2013:44-76.

- Boland, GW, Duszak R, McGinty G, Allen B. Delivery of Appropriateness, Quality, Safety, Efficiency and Patient Satisfaction. J Am Coll Radiol. 2014;11:225-226.

- Larson DB, Durand DJ, Siegel DS (2017) Understanding and applying the concept of value creation in radiology. J Am Coll Radiol. 2017;14:549-557.

- Hardy SM, Lexa FJ, Bruno MA. Potential implications of current corporate strategy for the US radiology industry. J Am Coll Radiol. 2020;17:361-364.

- Bruno MA, Mosher TH, Armah KO, Hardy SM, Abujudeth HH. Playing well with others: The challenge of academic and community radiology practice Integration. AJR. 2019;213:1-5.

- Harbaugh RE. Personal Communication. January 13, 2021.

- Moody’s affirms Radiology Partners’ Caa1 CRF; outlook changed to positive. Moody’s Investors Services. https://www.moodys.com/research/Moodys-affirms-Radiology-Partners-Caa1-CFR-outlook-changed-to-positive--PR_437001. Published December 3, 2020.

- Baxter, A. Top 10 highest physician salaries in 2019. HealthExec. https://www.healthexec.com/topics/healthcare-economics/top-10-highest-physician-salaries-2019. Published January 3, 2020.

- O’Connor M. Radiologists suffered 3% dip during pandemic, with overall physician pay holding steady. Health Imaging. https://www.healthimaging.com/topics/economics-policy/radiologists-salary-dip-pandemic-physician-pay?utm_source=newsletter&utm_medium=hi_news. Published April 16, 2021.

- CMS approves approximately $34 billion for providers with the accelerated/advance payment program for Medicare providers in one week. Centers for Medicare & Medicaid Services. https://www.cms.gov/newsroom/press-releases/cms-approves-approximately-34-billion-providers-acceleratedadvance-payment-program-medicare. Published April 7, 2020.

Penn State Health Milton S Hershey Medical Center, Hershey, PA. Dr Hardy is also a member of the Applied Radiology Editorial Advisory Board.